We don't know what we're betting

The countdown has probably already completed and Climate Change is inevitable, however to persist in making the same mistake will only give us the things to become worse.

The oil and coal lobbies have won the game of democracy. Polls continue to support who helps coal and oil industry. No matter the manifestations of April 2017 and many others can be made, the reality is who talk about “climate is normal” or minimize impact of it, has more credibility than all studies and proves of nature. I could recall previous articles about the reality that we perceive (see "Ignore the evidence") but the question is more complex than we might think.

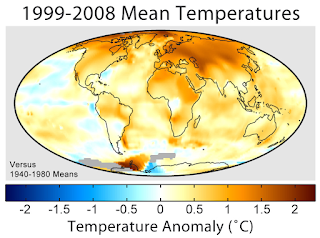

Warming without stop

In 2007, the world economy was blown up. The reasons are many but the main thing is that the world's wealth, or rather, what we understand how global wealth really doesn’t exist. Billion and trillions of euros is just a number in a computer. 90% of transactions in our world they are financial, and these are essentially bets about the price titles that will be dating in the near future, which represent some things which could be from shipping to insurance contracts about legs of sport players. If global markets don't differ in anything in the bookmakers online, these advertised so joyfully in internet or any sporting event advertising.

As explained in "Valor Preu i Qualitat" the price isn’t more than what we are ready to give in exchange for some other item that the owner of second item has also agree; the price is only an exchange agreement, obviously related to the real value of the objects exchanged, but not necessarily. The money had been a great invention in this regard that "homogenized" somehow these exchanges. But humans that tend to idealize and extrapolated have given materiality to the money (I don’t talk about the little buttons or stamps numbered which identify as metallic money) and exchange the money as something real.

The crisis of 2007 has shown that the current global wealth is not something real. Our pensions are pending if in seven years Brazil will suffer a drought, for example, something totally unpredictable; and the worst is that it all this pensions that depends of Brazil weather of 2025, the most are betting on the more likely to occur; whereas another part is betting against, so that their profits will be higher; no matter what will happen at last because someone will lose. We are talking about pension funds, but all the financial economy: capitalization of all types of industry or entire nations, are betting own capital. The situation may sound crazy but everything, including civic banking which only differs with the type of bet, is betting everything we’ve got unconsciously.

Betting is inherent to human. In fact, it isn’t good or bad, but it’s mandatory for any future decision that we must take, both in choosing job, partner or meal in restaurant. The issue isn’t on the bet but you're willing to lose. If you bet everything that you have, it can happen two things that win or lose, if you lose, you also lose everything. When this is done consciously, there is nothing to say, there would be some reason because you take this decision and it is a problem that you have. But, does we really know that we are betting?

To bet in fossil energy has enriched many people, added to unbridled energy consumption in the last quarter century, has carried to the most of the wealth, both large fortunes as small savers, to invest in this easy form to increase the money. Yes, your savings are invested in oil futures, states have the most of its money invested in oil and you wouldn’t think the business that its funding is guaranteed by oil extraction.

the veins of the economy

The bubble of oil and coal is much larger than the small crack of it in 2013 created a financial storm that now hasn’t still recovered (if anyone has an investment fund know that I speak) (though drivers they applaud). Paris fulfill commitments will involve severe financial losses that capital isn’t willing to hold, but the small middle class will be unattainable. We believe that the Paris Protocol is a commitment of minimums, so minimum that will not do anything; if we really want to do something valid, action must be so drastic that paralyzed the world economy.

The question we need to do is: Will we break the world economy to hope if we can back the climate problem? Or Will we continue fueling the climate system until it will be taking away ahead? This is the decision. There isn’t good news because the bet lose-lose, but while the first option may have some chance, the second will be a "game over" for our species. It is the hour of the brave and difficult decisions but today we’re playing if we have future or not as a species.

Despite the challenges, the transition to a low-carbon economy also presents opportunities for the oil and gas industry. Diversification into renewable energy sources, investing in clean technologies, and leveraging existing infrastructure and expertise can help companies adapt and stay competitive.

ResponEliminaIt is important for the oil and gas industry to proactively address the challenges of climate change, embrace sustainable practices, and actively contribute to the global efforts to reduce greenhouse gas emissions and mitigate the impacts of climate change

Freture Techno